DENVER — Alisha Gallegos’ purple and blue bus may look like a school bus, but it’s definitely not. It’s a cannabis consumption bus, only recently licensed for business by the City and County of Denver.

“What we’re trying to do is create responsible consumption practices,” Gallegos said “I saw the need for it.”

The bus can be rented out for weddings, private events, even festivals and can be smoked in.

“Definitely in the wedding market, when you go outside, and people are huddling in a corner or they’re, you know, trying to hide and smoke their cannabis,” Gallegos said.

Recent Stories from denver7.com

Now that the licenses are up, the bus is allowed to start rolling through the city. To get to this point Gallegos had to make tons of modifications to the bus to be compliant.

“There’s carbon filtration, I have a medical grade air purifier, we have to make sure that we have no visibility into the bus,” Gallegos said.

The bus driver has to be blocked off from the back of the bus and cannabis all together, to do that Gallegos had to install two doors, one that slides shut and another that zippers closed.

There are also multiple cameras recording every single thing happening inside of the bus.

“Everything has to be recorded and held for 45 days,” Gallegos said.

Even route logs with planned stops need to be approved seven days before an event.

“We can park in smoke, or we can drive in smoke,” she said.

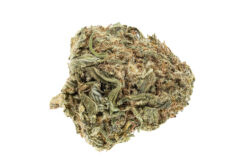

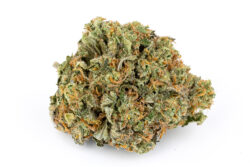

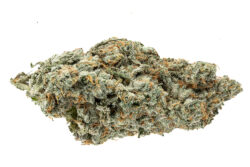

Although there is a vending machine filled with snacks and drinks on the bus, you’ll notice there’s no actual cannabis for sale on the bus. That’s because it’s ‘bring your own cannabis.’

Eric Escudero, the spokesperson for the Denver Department of Excise and Licenses says all of these requirements are in place for a reason.

“People can’t see consumption happening on them because we don’t want children to see that or markings that might reduce the perception of risk among children if they see a bus driving around Denver,” Escudero said.

These rules are something Gallegos doesn’t mind abiding by because following them means she’s compliant and therefore can continue working on building her business.